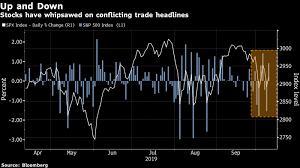

Banks and chipmakers led the S&P 500 Index higher, with an extra boost after President Donald Trump confirmed talks will continue Friday, after an overnight session that saw futures whipsawed by headlines giving conflicting signs of progress on the negotiations. The dollar fell, brushing off a weak inflation reading as all eyes remained on trade. Ten-year Treasury yields approached 1.65%.

Among the latest developments:

- Chinese delegates are meeting with Trump administration officials Thursday and Friday

- A Chinese official said the country was open to reaching a partial deal

- The U.S. is seeking to include a previously-agreed currency pact on part of any accord

- China plans to ask for sanctions relief on its top shipper

- China increased purchases of U.S. pork last month

“China trade talks are really dominating everything and we’ve seen how unpredictable they can be,” Chris Gaffney, president of world markets at TIAA, said by phone. “We’ve seen it move just back and forth so dramatically. I think everyone’s really going to have to wait until a deal gets actually done.”

Elsewhere on Thursday, the Stoxx Europe 600 Index and the British pound extended gains after U.K. Prime Minister Boris Johnson and his Irish counterpart Leo Varadkar said they could “see a pathway to a possible deal” on Brexit.

Crude rose after OPEC Secretary-General Mohammad Barkindo said members and allies including Russia will do “whatever it takes” to prevent another oil slump as the global economy weakens.

Asian shares ended the session mixed, with Japanese equities recouping their declines by the close, South Korea down and Hong Kong and Shanghai notching modest gains.