Tag:

CBN

search

Latest Post

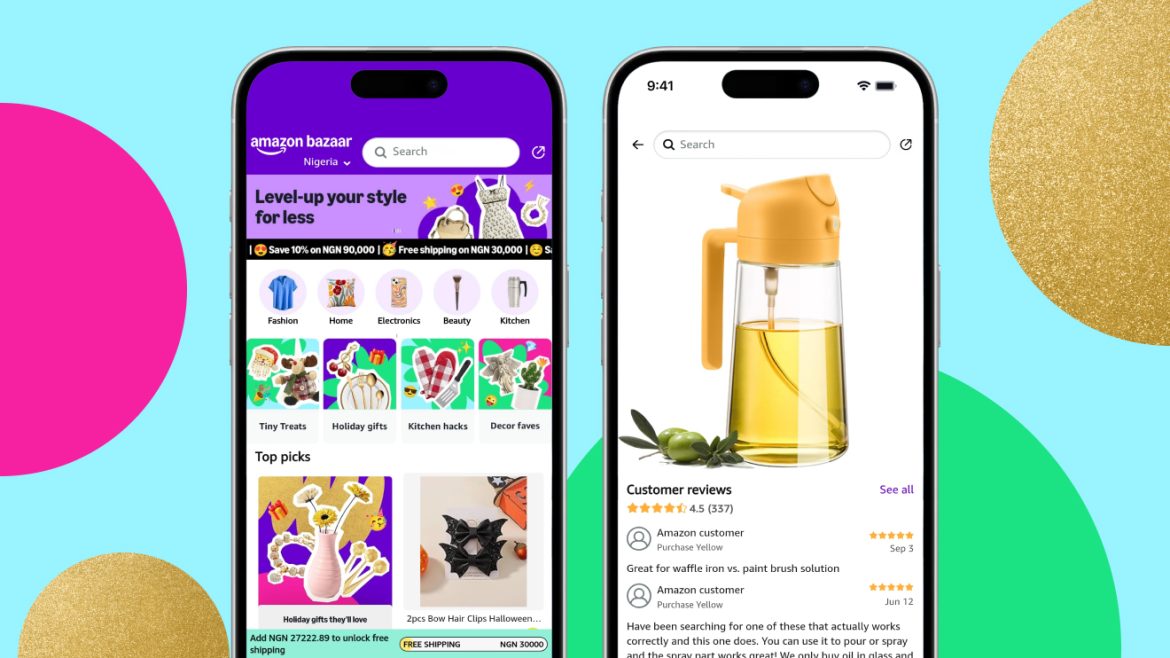

Amazon enters Nigeria’s e-commerce race with budget-friendly Bazaar app

by Onome Amuge

written by Onome Amuge

Travelex positions for rebound as Nigeria’s currency reforms take hold

by Onome Amuge

written by Onome Amuge

Ransomware forces majority of retailers to settle with attackers

by Joy Agwunobi

written by Joy Agwunobi

Unitrust Insurance earns “A” rating from Agusto & Co with stable outlook

by Joy Agwunobi

written by Joy Agwunobi

Leadway Pensure PFA marks 20 years of trusted pension service

by Joy Agwunobi

written by Joy Agwunobi