By Bruno Lanvin

Who will finance innovation beyond Covid-19?

Necessity is the mother of invention. Indeed, during the global coronavirus crisis, the world needed to move work, education and play to the digital realm very quickly. One example of an accelerated adjustment is how Slack, the online collaboration hub, has managed to innovate to help companies around the world pivot to remote working (as well as hiring, onboarding and training) within days. Innovation in such times is crucial, but may also increase inequalities among countries, sectors and groups of population.

As the world continues to face a prolonged, massive health crisis, and prepares for the accompanying economic and social shocks, the question of “Who Will Finance Innovation?”, the theme of this year’s Global Innovation Index (GII), is critical in solving the seemingly insurmountable problems ahead of us.

Any crisis calls for a variety of short-term responses to the emergency at hand. But longer-term objectives must be safeguarded. Innovation financing is generally regarded as a long-term investment (especially in science and technology); a growing concern is that it may be sacrificed to more immediate economic and social demands.

A collaboration between INSEAD, Cornell University and the World Intellectual Property Organization (WIPO), the GII measures a country’s innovation performance based on its innovation inputs (such as national R&D spending, higher education, the regulatory environment and infrastructure) and innovation outputs (like intellectual property or other knowledge creation). This 13th edition of the index ranks 131 countries. Our aim is to provide insightful data on innovation and, in turn, assist policymakers in evaluating their innovation performance and making informed innovation policy decisions.

The impact of the current crisis on innovation is uncertain and highly dependent on a range of recovery scenarios, as well as business and innovation practices and policies. In any scenario, financial resources – both private and public – will be strained. Countries and corporations alike might find it harder to pursue investments and innovation. Historically, pandemics have been followed by sustained periods of depressed investment. Investment rates are already low to date, including foreign direct investment, which is now expected to drop sharply in 2020 and 2021.

Yet, prior to Covid-19, financing had been growing and diversifying. Since the financial shock of 2008, there were positive signs of recovery around the globe. Over the last decade, average innovation expenditures worldwide have been growing faster than GDP. In 2017, R&D expenditure grew by 5 percent and by 5.2 percent in 2018 – in line with the strong growth of the pre-crisis period and significantly stronger than global GDP growth. This growth was sustained by increased expenditures in key emerging markets, such as China (14) and India (48), and by leaders in high-income economies.

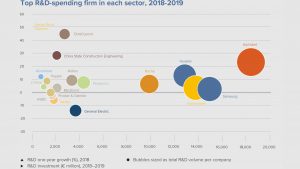

When governments started to phase out the innovation stimulus measures created after the 2008 crisis, private sector funding drove much of the growth in innovation expenditure. In 2018, the top 2,500 R&D companies invested €823 billion in R&D, an annual increase of 8.9 percent. Venture capital (VC) and other sources of innovation financing were at an all-time high. Novel innovation financing mechanisms, including sovereign wealth funds, IP marketplaces, crowdfunding and fintech, contributed to the spike in innovation finance.

Now, in the time of Covid, financial resources will be more restrained as the International Monetary Fund has predicted global GDP will shrink by 4.9 percent this year. The massive recovery packages announced (such as those by the European Union or the United States (3)) will largely dictate where available resources will go.

Impact of the coronavirus recession

As global economic growth declines this year, the question is whether R&D expenditures will fall or remain resilient in the face of the crisis. Past crises have had heterogeneous effects on different sectors and countries, with some stimulating innovation and others weakening it with austerity measures.

Certain innovative sectors are expected to thrive. Even within such sectors however, the picture will remain contrasted. Let us take the example of information and communication technology (ICT), where software and hardware face different opportunities and challenges.

Large ICT software firms hold vast cash reserves, and with the pandemic-fuelled increase in internet activity, online education and remote work, revenue may in fact increase for some companies. In the GII, software and ICT represent only 15 percent of R&D top spenders.

On the other hand, the largest global R&D spending sector, ICT hardware and electronic equipment, will see more direct revenue impact, due to a combination of global supply chain issues and falling consumer demand. Although firms like Samsung, Huawei and Apple have already seen a downturn in their first quarter results, most technology companies have significantly increased their first quarter 2020 R&D expenditures.

Pharmaceuticals and biotech, near the top of sector spenders, are likely to experience resilient revenue and R&D growth, especially as the race for a vaccine continues.

Transport, one of the most severely hit sectors, will need innovation to survive, in particular by fostering technology changes to make cars, planes and trains more energy efficient and climate friendly.

Some countries have already begun the transition from containment to recovery measures. France (12) has pledged €5 billion in public support to innovative firms, a 25 percent increase in its original R&D budget. It is also fast-tracking R&D tax credits. To build infrastructure and boost innovation, China intends to focus on big data centre creation, 5G infrastructure and new energy vehicles.

The top 10 and beyond

Stability remains at the top of the GII rankings; out of this year’s top 10, nine were in last year’s list. The innovation champion recipe remains the same: an overall balanced performance across all pillars, with a special focus on infrastructure and those policies that foster openness and education. By and large, it is still too early to see the impact of the pandemic. Relevant data will only show in corporate reports and national accounts from the second half of 2020, and it will be important to assess then how the two fundamental pillars of innovation – openness and education – have been affected.

Switzerland (1), Sweden (2) and the US are unchanged at the very top. This year’s sole new entry in the top 10 is the Republic of Korea (10). Intense competition follows after that, with a remarkable move by France, jumping four ranks, allowing it to overtake China.

India has also performed well this year, breaking into the top 50. In terms of innovation performance, 2020 has shown strong performance across Asia: Economies in which governments consider innovation as a strategic priority rank well. Singapore (8) continues to shine. China’s position as a major global player on the innovation scene is stable; its sizeable internal market and relatively high growth rate will help pursue the trend. Other Asian middle-income economies, such as Malaysia (33), Viet Nam (42) and the Philippines (50) prove dynamic.

The GII bubble chart is perhaps the clearest measure to identify innovation outperformance relative to an economy’s level of development. Regionally, Africa shines on this count.

Out of the 25 economies identified as outperformers – more innovative than their economies belie – eight are from Sub-Saharan Africa.

For example, innovation leaders in Africa such as Botswana (89) and Tunisia (65) usually have higher expenditures in education, while South Africa (60), Kenya (86) and Egypt (96) invest in R&D. Innovation is also more pervasive in Africa than what existing data suggest.

Regional divides persist, yet some economies harbour significant innovation potential. Latin America and the Caribbean continue to be a region of significant imbalances with low investments in R&D and innovation.

But the gap between rich and poor countries is widening and needs to be considered in terms of innovation funding in post-pandemic times. Two spectres loom large across poorer countries: Persistent inequalities and rampant global protectionism dressed up as “Made in OUR home country” work around the pandemic-era supply chain problems. A less fluid global environment would be particularly detrimental to poorer economies.

Post-pandemic lessons

To remain at the top, today’s innovation champions must continue to invest in novel education and keep their countries open for business and open to the world.

What we have seen from recovery packages strikes a healthy balance between the need to protect jobs and retain stability in the short run and the need for longer term changes (e.g. through digital transformation and fighting climate change). This is the path along which innovation financing will not fall as a collateral damage of post-Covid policies. Sustained financing for the UN Sustainable Development Goals (SDGs) and innovation should remain high global priorities as they go hand in hand.

Every crisis brings opportunities and room for creative disruption. One side effect of the current crisis has been an increased interest in innovative solutions for health, naturally, but also in areas such as remote work, distance education, e-commerce and mobility solutions.

Fundamentally, the pandemic has not changed the fact that the potential for breakthrough technologies and innovation abounds. The GII continues to support and foster innovation through challenging times. At this juncture, with increased unilateralism and nationalism, it is important to remember that most economies that have moved up the ranks in the GII over time have strongly benefitted from their integration within global value chains and innovation networks.

The GII will track this phenomenon closely in future editions and continue to enable policy and business leaders by fostering a better understanding and measurement of innovation.

The GII is created by INSEAD, the World Intellectual Property Organization (WIPO) and Cornell University. It covers 131 economies around the world and uses 80 indicators across a range of themes. The full report with complete rankings is available here.

Bruno Lanvin is the Executive Director for Global Indices at INSEAD. He is a co-editor of the Global Innovation Index.