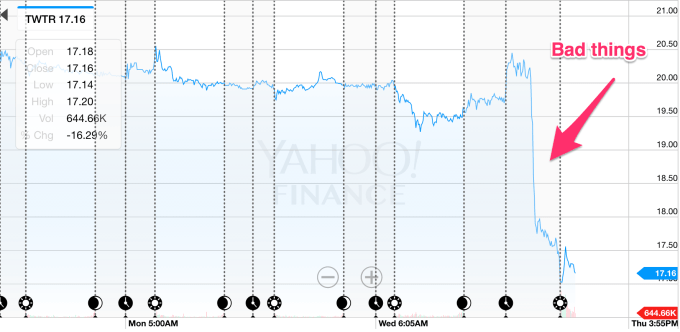

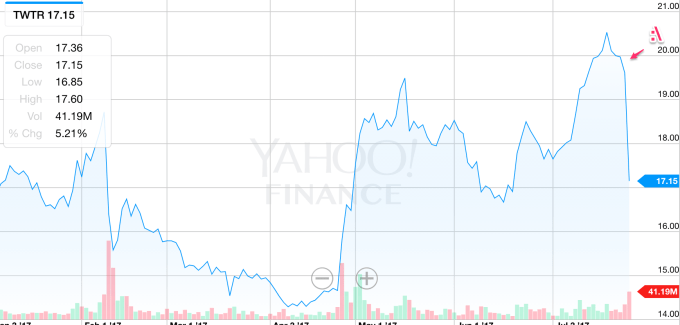

Twitter reported its second-quarter earnings yesterday, July 27, and it did not go over well. As a result, the stock is down more than 12% in trading, which is a very Twitter thing to happen.

Here’s the chart, which could pretty much be summed up with a:

Also wiped out most of the gains that it accrued year to date. Twitter’s last report was a rare positive one for the company when its monthly active users actually grew faster than expected and everything came in ahead of Wall Street’s analysts. This quarter, the very Twitter move of its users not growing and its advertising business stalling happened once again and shed more doubt on the company’s future.

To be fair, the company is still more or less being gauged on the growth of its monthly active users. And Twitter’s actual audience has always been a pretty hard thing to gauge given that a lot of content bleeds beyond the platform and it’s trying to further expand into live video. The company has tried to distance itself from that MAU metric because, for better or worse, its growth is probably being sized up against other advertising networks like Facebook.

That stock dive is really a reevaluation of the company’s future success, but it certainly doesn’t help it in the short term. Twitter is trying to get its stock-based compensation under control, but it’s also important to keep that price up to help recruit additional talent and improve morale. Twitter is rapidly trying to roll out products that will help make the service better, like trying to curb harassment and making the service easier to use with algorithmic feeds.

To counter that obsession on MAUs, Twitter has started to emphasize its growth in its daily active users. That’s the strategy that Snap employed in its pitch that it’s an alternative to Facebook. The goal is to convince Wall Street that its eyeballs are more valuable than Facebook’s eyeballs because the service is much more engaging, and people spend a lot more time looking at Twitter multiple times throughout the day. Better engagement means more expensive ads, which means that the company will be able to restart its engine — but that means it has to grow those DAUs.

Still, Twitter isn’t being to open about those DAUs, and instead doing the Very Tech Move of telling us the growth rate and giving us a chart without a Y axis when talking about its DAUs. We may, in the future get more clarity, but for now that’s not helping Twitter’s case as being a potentially huge advertising product alongside other options in the market.