Wall Street’s main indexes rose on Wednesday as fears of a global economic slowdown were calmed by robust economic data from China, while easing tensions in Hong Kong added to an upbeat mood.

Activity in China’s services sector expanded at the fastest pace in three months in August, providing a boost to the world’s second-largest economy that has been struggling to reverse a prolonged slump in its manufacturing sector.

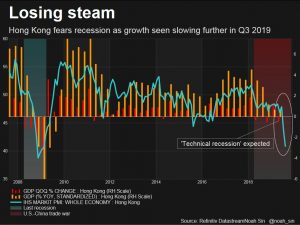

The mood also got a lift after Hong Kong leader Carrie Lam withdrew an extradition bill that had triggered months of often violent protests in the Chinese-ruled city.

“This is a sentiment driven market and whenever you get news like this, while it may not directly impact the U.S., it causes a ripple effect,” said Ryan Nauman, market strategist at Informa Financial Intelligence in Lake Taho, California.

Markets struggled last month as escalating trade tensions and the inversion of a key part of the U.S. yield curve, often seen as a sign of recession, drove investors away from risky assets and pushed the S&P 500 to log its worst August in four years.

A contraction in U.S. factory activity in August only added to those concerns on Tuesday.

However, risk sentiment improved on Wednesday, pushing the benchmark U.S. Treasury 10-year yield US10YT=RR higher, with the yield curve at its steepest in more than two weeks.

Helping cool slowdown concerns were comments from New York Federal Reserve President John Williams who said the economy appeared to be in a good place and he is ready to “act as appropriate” to help avoid a downturn.

Ten of the 11 major S&P sectors were higher, with a 1.48% rise in technology stocks providing the biggest boost.

The U.S. nonfarm payrolls report due Friday will also be a critical piece of data, with some analysts cautioning that any weakness could be taken as a major signal that the domestic economy is slowing.

“The strong labor market and consumer is what’s driving economic growth and if we start seeing cracks in the labor market, that would give me pause that a recession is on the horizon,” Nauman said.

However, he added weakness in the labor market could pressure the Federal Reserve to cut interest rates by as much as 50 basis points in its mid-September meeting. Market participants are currently expecting a quarter percentage point cut.