| What shaped the past week?

Global: With investors’ focus largely on the Jackson Hole summit slated for Friday as well as recession concerns higher energy prices, global markets closed lower this week. Starting in the Asian-Pacific region, China’s zero-covid policy has seen lockdowns persist in key cities, weighing on supply out of the country. Additionally, the People’s Bank of China cut its primary lending rate and provided other stimulus measures to support its property market, which came under pressure of a stalling economy. In the region, the Shanghai Composite sank 0.67%, while the South Korean KOPSI and the Japanese NIKKEI fell 0.47% and 1.00% respectively. on the other hand, the Hong Kong Hang Seng index rose 2.01%, the best performance worldwide. In the European region, surging gas and electricity prices have seen consumer prices come under enormous pressure, unnerving investors in the region. Russian state-owned firm Gazprom plans to shut down the Nord Stream 1 pipeline at the end of August to stock supplies for the winter season. Investors remain unnerved by the possibilities of a shortfall in supply in an already tight market. For the indices, the German Dax, French CAC, and the London FTSE-100 fell 2.18%, 1.86% and 0.88% w/w respectively. Finally, in the U.S. as all eyes have turned to this week’s Fed Jackson Hole Symposium, with investors in the region digesting the latest economic and earnings data. In all, key markets in the U.S. were lower w/w, with the S&P 500, Nasdaq, and Dow Jones down 1.04%, 0.75%, and 1.47% respectively.

Domestic Economy: The domestic economy grew by 3.54% year on year in Q2’22. Increases in service (+3.2% y/y) and agricultural (+7.4% y/y) output aided the expansion. The top five contributors to growth were ICT, trade, finance, transportation, and crop production, which were fuelled by SIM registration relaxation, border reopening, and government and CBN interventions. Meanwhile, industry output remained subdued in Q2’22, falling by -2.3% year on year, just as output in the oil sector contracted for the ninth consecutive quarter. Looking ahead, we expect full border reopening, crude production, and government interventions to drive growth.

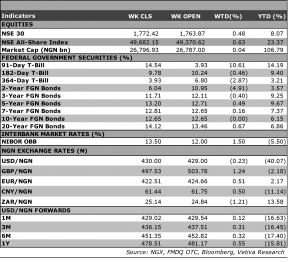

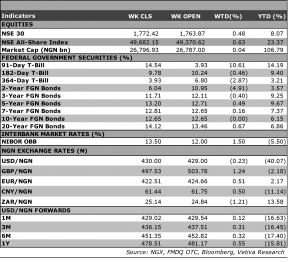

Equities: Nigerian equities edged moderately higher w/w, as the NGX rose 0.63% w/w to settle at 49682.15pts, driven by interest in the Telecommunications space. However, all other key indices on closed lower w/w; with the Oil and Gas and Industrial Goods sectors falling 4.08% and 4.19% respectively. In the Oil and Gas space, a downturn in SEPLAT primarily drove the sector lower; the government is still yet to approve the company’s acquisition of ExxonMobil assets in the country, and this has weighed on the counter in recent sessions. Meanwhile, in the industrial Goods space, cement giant DANGEM saw its value sink 5.33% w/w dragging the sector lower. Likewise in the Consumer Goods space losses in key names weighed on its performance as the sector lost 2.23% w/w; FLOURMILL and BUAFOODS fell -7.06% and 6.92% respectively as investor sentiment wanes in the space. Finally, the banking sector was largely muted this week as investors digested the latest earnings of the nation’s lenders; the sector lost 0.69% w/w.

Fixed Income: Trading across the fixed income space was largely mixed this week, as investor focus shifted to the NTB auction that was held on Wednesday. On behalf of the DMO, the CBN offered and sold 295 billion across the 91-Day, 182-Day, and 364-Day tenors at stop rates of 4.00%, 5.00%, and 8.50%. In the bonds space, investors remain sell-sided driven at the short-end of the curve, evidenced by the 99bps uptick in the yield on the 13.53% FGN-MAR-2025 to 13.10%; while being largely buy-side driven at the long-end. Yields across benchmark bonds rose 12bps on average, with investor look to the latest batch of economic data out of the country. Meanwhile, as system liquidity was largely constrained this week, trading activity in the NTB and OMO spaces were muted, as yields closed flat across the respective markets.

Currency: The Naira depreciated 5bps w/w at the I&E FX Window to ₦429.05.

| What will shape markets in the coming week?

Equity market: This week’s bearish sentiment can be seen in the 59bps w/w dip in the ASI and with the current sentiment in the market, we expect neutral to negative sessions next week with pockets of positive close across sectors.

Fixed Income: The NTB market is expected to open on a quiet note next week, as investors remain on the side lines ahead of the NTB primary market auction on Wednesday. Similarly, given the current liquidity squeeze, the bonds market should continue to trade on a tepid note, with a strong bearish undertone.

ZENITH BANK PLC – PBT grows 11% y/y amid increased impairments

In its recently released H1’22 financials, ZENITHBANK saw Gross Earnings rise by 17% y/y to ₦404.8 billion, 2% above our estimate of ₦397.4 billion. The improved earnings came about after Interest Income grew 19% y/y to ₦241.7 billion (Vetiva: ₦252.7 billion), thanks to a 21% y/y increase in receipts from loans and advances. Meanwhile, Non-Interest Revenue (NIR) grew 18% y/y to ₦148.9 billion (Vetiva: ₦128.7 billion), after a 44% rise in trading income, specifically from T-bills.

Conversely, the bank’s Interest Expense went up 30% y/y to ₦56.9 billion (Vetiva: ₦52.9 billion), as the bank reported higher payments on all account types as well as borrowings. Margin-wise, we estimate that Cost of Funds (CoF) advanced 10bps y/y to 1.4%, while Net Interest Margin (NIM) grew

70bps to 7.1%.

On the cost side, Impairment charges rose 27% y/y to ₦25.1 billion, while Opex grew by 19% y/y to ₦178.6 billion; this was driven by a 16% increase in AMCON charges. Overall, the bank posted an 11% increase in PBT to ₦130 billion, while bottom line grew by a more modest 5% y/y to ₦111.4 billion.

Higher MPR, savings costs to dampen NIMs in H2

The hikes in MPR, the first of which came at the end of Q2, had a general impact on ZENITHBANK’s cost of funds. Net Interest Income was 8% below our initial expectation specifically because of higher fees paid out to customers for their deposits, which grew 11% YTD. Despite this, the consistent asset yield on an expanded loan book (+23% y/y) meant that NIMs grew during the period. However, with the implementation of a new minimum saving rate of 30% of MPR (4.2%) and the likelihood of further MPR hikes in coming months, we anticipate a decline in NIMs by the end of the year, albeit slightly offset by higher interest on loans and advances.

TP revised to ₦38.00 (Previous: ₦40.00)

We have slightly adjusted our projections based on H1 performance. Firstly, we have moderated our Interest Income forecast to ₦492.9 billion (Previous: ₦505 billion), while Interest Expense has been increased to ₦124.5 billion (Previous: ₦108.4 billion). We also increased our impairments forecast to ₦63.7 billion (Previous: ₦52.2 billion). Overall, our adjustments yield a new PAT figure of ₦236 billion (Previous: ₦256 billion). Our new projections yield us an expected EPS of ₦7.53 (Previous: ₦8.17). Therefore, we revise our 12-month target price (TP) to ₦38.00 (Previous: ₦40.00). The stock has lost 12.5% YTD and is currently trading at a P/B of 0.5x, in line with Tier-I peer average of 0.5x . |

|