Emerging markets including China and India could be the best bets for investors hoping to fight climate change and boost returns, according to a report Thursday.

If the planet heats up by 5 degrees Celsius (9 degrees Fahrenheit), well above the 2-degree threshold set by the Paris Accord, investors may face $7 trillion in global losses. But that could be mitigated by investments aimed at reducing and removing carbon from the atmosphere, according to the report by Morgan Stanley’s Institute for Sustainable Investing and The Economist Intelligence Unit.

Emerging economies from China to Cuba to Nigeria present some of the biggest opportunities for investors as they become centers of clean energy innovation. These regions are likely to be significantly affected by a warming planet and have increasingly tech-savvy populations, according to the report.

“Countries are in different stages of development in terms of their energy and power infrastructure, so their needs may be very different,” Hilary Irby, co-head of the global sustainable finance group at Morgan Stanley, said in an interview. “In some cases, you have countries that may be able to skip traditional infrastructure.”

Nigeria, for example, has a rapidly developing solar industry and expects energy consumption to grow almost 14 percent by 2020. And Cuba, where the energy market is expected to see double-digit growth over the next five years, recently opened a renewable energy research and development center. India offers opportunities for clean transport because vehicle demand is expected to double by 2020, according to the report. Bloomberg New Energy Finance expects more than $4 trillion to be invested in renewable electricity generating capacity in Asia by 2040.

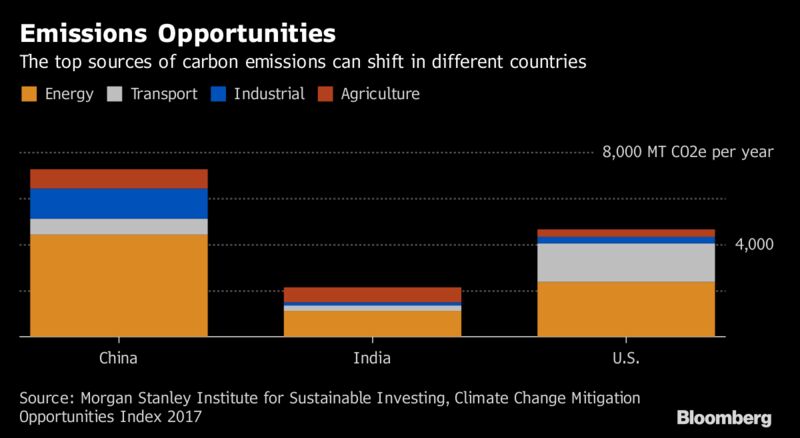

While energy tends to be the leading target for climate-change mitigation, the opportunities to curb emissions from agriculture are highest in China, India, and Brazil, according to the Morgan Stanley report. The biggest opportunities for reducing transport-related emissions reductions are n the U.S., China, India, Brazil and Mexico.

Regulatory changes will also play a role in determining the industries investors can tap into to fight climate change. Countries like China and India can see renewable energy as a path to reduce poverty, create jobs and improve energy security and social stability, according to the report.

“China’s announced ban on gas and diesel powered cars is likely to change the game for the energy sector and automobile sector and the implications will be felt broadly,” Irby said. “They’re not the first country to make such an announcement, but they are so large that they are creating a significant new market opportunity through a policy decision specifically related to climate change mitigation.”

Report courtesy Bloomberg