By Philip Eyam-Ozung

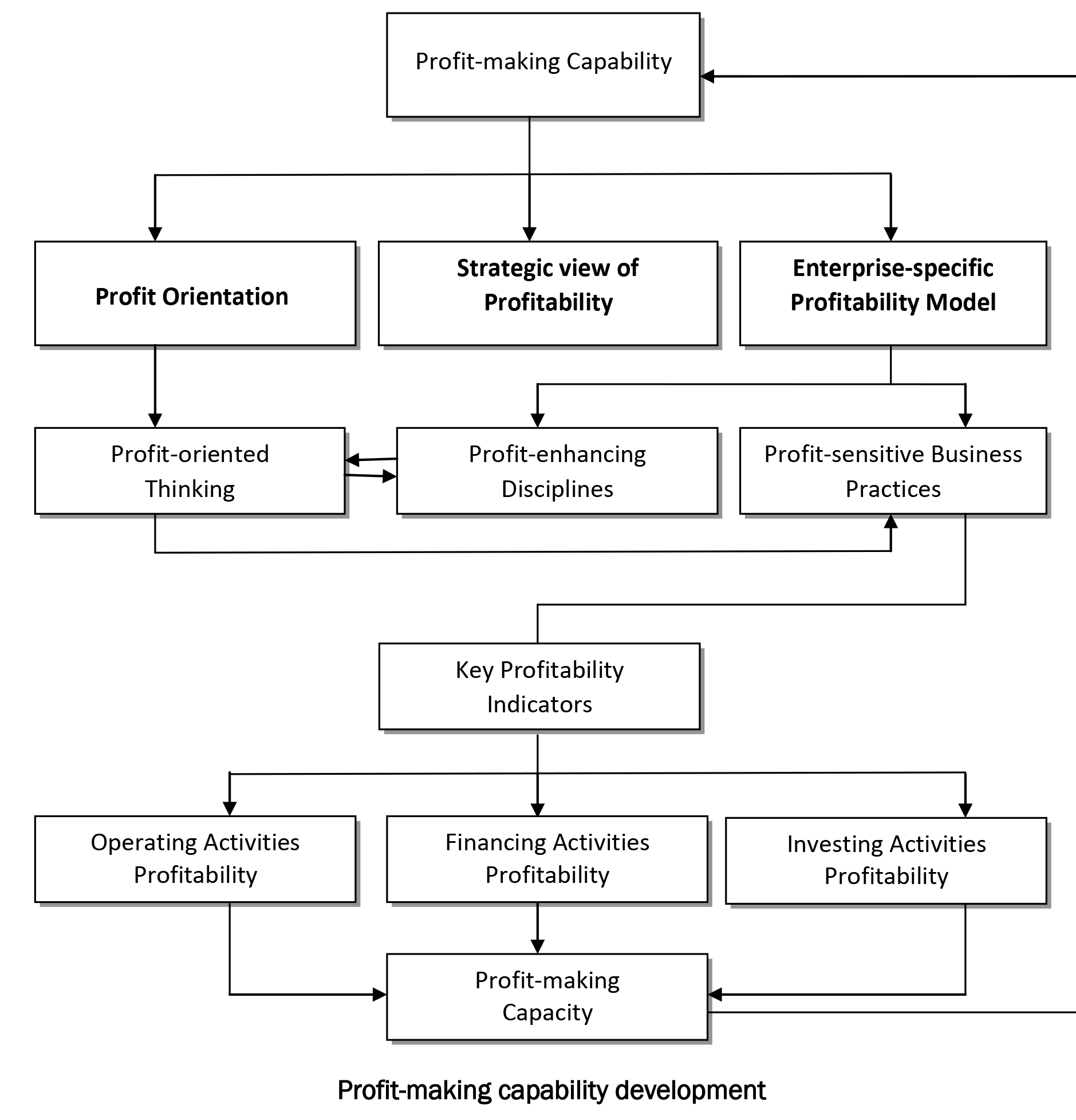

ENTREPRENEURIAL STRATEGY IS ONE OF THE KEY DOMAINS of entrepreneurship that will be most fundamentally impacted by the introduction of the concept of Trilateral Entrepreneurship. In this connection, the concept and practice of entrepreneurial strategy will be radically transformed by the core strategy of Trilateral Entrepreneurship which is to develop operating, financing and investing activities as profit-impacting activities. While the strategic plot is to premise the design and development of the operating, financing and investing capabilities of a business on a well-defined Profitability Model, the priority is to ensure that the Profitability Model that is used to shape the development of operating, financing and investing capabilities is philosophically and practically balanced especially in terms of:

Reflecting the deeply-entrenched profit orientation of the entrepreneur and his enterprise

Being more strategic than transactional

Being designed to instill profit-enhancing disciplines and

Emphasizing profit-sensitive business practices!

It is imperative to emphasize the point that the journey to both the development of profit-making

capability and actual profit-making begins with the entrenchment of profit orientation as a core

value (or shared value) that is intended to permeate the thinking of everyone in the enterprise.

The key is to understand both that:

The first key requirement for the development of the operating, financial and investment

capabilities of a business as prima facie profit-impacting activities is the entrenchment

of profit orientation across the organization or government and

Profit orientation can only take root when every stakeholder is encouraged and empowered to question the profitability of any aspect of the business to which he is privy

The practice of proving profit orientation by consistently questioning the profitability of all proposals, decisions and plans that are linked to the business is especially important because it is the strength of the profit orientation of an organization that directly determines how much commitment it will bring to bear on the development of profit-making capability and the entrenchment of profit-enhancing disciplines and profit-sensitive business practices.

The second benefit of entrenching profit orientation as a core value (or shared value) that is intended to permeate the thinking of everyone in the organization is that it sends the signal that everyone in the organization is equally responsible for contributing to the profitability of the business. That is, profit orientation makes everyone in the organization or government espousing it a key contributor to company or government profitability. It is imperative to reiterate the point that profit-making requires deeply-entrenched organization-wide or government-wide

profit orientation. Profit orientation is especially important because it both promotes profitoriented thinking and signals that an organization or government is demonstrably committed to profit-making. As a matter of fact, it can be argued that the failure to entrench profit orientation as a core value that is intended to permeate the thinking of everyone in an organization is bound to limit that organization’s profit-making capability and profit-making capacity.

Keeping profit-making more strategic than transactional

The development of the operating, financial and investment capabilities of a business as the cornerstones of its profitability also requires deliberately keeping profit-making more strategic than transactional. That is, profit-making requires the development and maintenance of a pervasively strategic view of profitability. The strategic view of business profitability is especially important because transactional profit-making promotes a short-term profitability calculus that easily poses-long term risks such as profit growth targets that are either unrealistic and

therefore, unattainable or unsustainable. The need to target sustainable profit-making cannot be over emphasized. In their recently-published book entitled GO LONG, Carey, Useem, Dumaine and Zemmel advocate long-term thinking as the best short-term strategy! The real challenge of sustainable profitability is to maintain the right balance between short-term profits and longterm profit growth.

The Profitability Model

In addition to the entrenchment of profit orientation as a core value that is intended to permeate the thinking of everyone in an organization and deliberately keeping profit-making more strategic than transactional, the development of the operating, financing and investing activities of a business as the cornerstones of its profitability requires the construction of an enterprisespecific Profitability Model that is built on the combination of profit-enhancing disciplines and profit-sensitive business practices. While the construction of an enterprise-specific Profitability

Model requires good profit-making capability development which is highly specification-driven,

the profit-enhancing disciplines and profit-sensitive business practices that are the building

blocks of the Profitability Model of a business include cost consciousness, waste curtailment,

value-for-money approaches, continuous improvement, process optimization, resource sharing,

cost efficient sourcing of business input and delayed gratification. Thus, a well-defined

Profitability Model will be specific on key profitability indicators such as short-term profit targets,

long-term profit growth targets, profit retention/re-investment targets, profitable cost limits, cost

effectiveness/efficiency/reduction targets, competitive product/service pricing targets, and

waste curtailment targets. A Profitability Model is always as good as its key specifications.

The key to developing the operating, financing and investing capabilities of a business as the

cornerstones of its profitability is to hinge all operational, financial and investment decisions,

plans and actions on the specifications of an underlying Profitability Model. This is especially

important because any poor specification of the Profitability Model of a business is bound to

undermine the profitability of its operational, financial and investment decisions and actions and

where this is the case, the business will invariably default to running at a loss! In any case, the

evidence is that each organization’s profit-making capacity is directly determined by the scale

and scope of its profit-making capability.

Conclusion

1. As the fundamental means of shaping entrepreneurial thinking and behavior as well as the

core driver of profitable entrepreneurship, profit orientation is the motive-force of

entrepreneurial philosophy

2. The entrenchment of profit orientation is the first sign of an organization’s commitment to

profit-making and the signal that everyone in the organization is an equal contributor to its

profitability

3. Profit orientation drives profitability by fostering profit-oriented thinking and increasing the

affinity for profit-enhancing disciplines and profit-sensitive business practices

4. It is hard to imagine how an entrepreneur or enterprise can engage in profit-oriented thinking

or demonstrate sufficient affinity for profit-enhancing disciplines and profit-sensitive

business practices without first being demonstrably committed to the entrenchment of

deeply-rooted profit orientation

5. While it should ordinarily be expected that all profit-seeking organizations will be best known

by their pervasive profit orientation, the evidence is that this is not the case. Paradoxically,

the vast majority of profit-seeking organizations tend to be solely focused on profit-making

that is hardly rooted in the cultivation of profit orientation as a shared value that is intended

to permeate the thinking of their leadership and every member of their workforce

6. It is not far-fetched to argue that the failure to cultivate profit orientation is the single factor

that most fundamentally undermines the profit-making capability and profit-making capacity

of as many entrepreneurs and enterprises

7. While each organization’s profit-making capacity is directly determined by the scale and

scope of its profit-making capability, its profit-making capability is directly determined by the

quality and strength of its Profitability Model

8. Since the Profitability Model is highly specification-driven, any poor specification is bound to

severely limit the extent to which an organization’s Profitability Model can support its

profitability

9. The overall strength and performance of an enterprise-specific Profitability Model depend on

whether its design and specifications are based on a strategic or transactional view of

profitability and

10. The success of entrepreneurial strategy ultimately rests on the entrepreneur’s grounding in

the construction and activation of the Profitability Model that can best enable him to

optimize his profit-making capability and profit-making capacity!

The secret of great entrepreneurial strategy-making is to prioritize the assurance of the profitsensitivity and overall profitability of the operating, financing and investing activities by keeping

them fully-aligned with the specifications of the organization’s Profitability Model.

PHILIP EYAM-OZUNG

Principal Consulting & Coaching Executive