Bears are dominating the oil market.

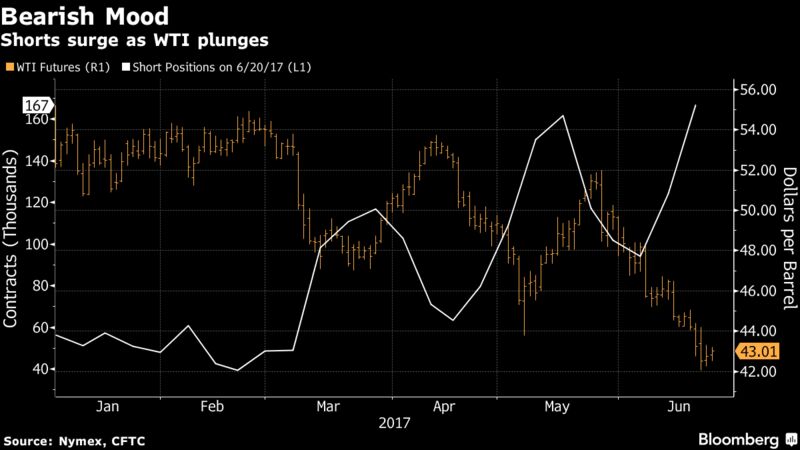

Hedge funds cut bets on rising West Texas Intermediate crude prices by 31 percent in the week ended June 20, pushing their net bullish position to the lowest in 10 months just as the U.S. benchmark slipped into a bear market. Wagers on declining prices reached a new high for the year.

“It matches up with the very negative sentiment tied to oil prices right now,” said Rob Thummel, portfolio manager at Tortoise Capital Advisors LLC in Lakewood, Kansas, which manages about $16 billion in energy-related investments. “The bears are not going into hibernation yet. They’re still hungry.”

WTI and Brent, the global benchmark, both entered bear-market territory last week, meaning prices have fallen more than 20 percent from this year’s peaks. Weighed down by rising output from the U.S., Libya and Nigeria, the oil market has now given back all of its gains since OPEC led an historic agreement late last year to cut production.

Money managers’ WTI net long positions, the difference between wagers on a price increase and bets on a decline, fell by 60,556 to 134,742 contracts, according to data from the U.S. Commodity Futures Trading Commission released Friday. Long positions fell by 5.7 percent to 301,476, the lowest in almost eight months, while short positions grew by 34 percent to 166,734, the most since August, the CFTC said.

Bets on falling gasoline prices reached their highest level in six weeks while bearish positions on diesel were the largest in a year and a half, according to the CFTC.

U.S., India seek rapport despite friction on trade, immigration

“These are people who are not just running away from the price decline but are actively positioning to take advantage of further price weakness,” said Tim Evans, a Citigroup Global Markets analyst in New York. “These people are really bearish.”

OPEC Talks

Oil prices notched their fifth weekly decline last week. Sentiment took another hit after talks in Vienna between the Organization of Petroleum Exporting Countries and allies including Russia. The producers focused on how to deal with surging Libyan and Nigerian production but didn’t have a serious discussion about deepening output cuts by other members, according to delegates familiar with the talks.

U.S. oil production rose by 20,000 barrels a day last week to 9.35 million, the Energy Information Administration reported Wednesday. While crude stockpiles slid by 2.45 million barrels to 509.1 million, a steeper decline than forecast in a Bloomberg survey, inventories remain about 100 million barrels above the five-year average.

Qatar’s emir meets Exxon Mobil Corp CEO over energy supply talks

WTI for August delivery on Monday rose as much as 1.4 percent in New York after falling 3.9 percent the previous week. The contract was trading up 1.2 percent at $43.54 a barrel as of 12:01 p.m. in Singapore.

The CFTC numbers showed about twice as many money managers took long positions as short ones, compared with a peak of almost 12 times more longs in February. That could be a sign the sell-off has reached its limit, Thummel said.

“It’s near the lows of what it’s been this year, which to me signals that we’re closer to a bottom,” he said.

Follow Businessamlive on Twitter and Facebook.

Courtesy Bloomberg