By Noah Smith

Economists have lately been rethinking free trade. They’re right to do so — and not just because China’s emergence came as such a big shock to U.S. workers.

There used to be a near-universal consensus among academic economists that the best trade policy for any country was to unilaterally remove all barriers and distortions, even if trading partners didn’t do the same. As long as distributional issues could be handled — by helping people who lost jobs to competition — free trade was seen as a no-brainer.

This cozy consensus has been challenged by analyses of trade with China in the 2000s. During previous episodes of globalization, workers displaced by international competition had found new jobs for similar pay. But when trade was opened up with China, a fifth of humanity — highly productive workers with very low pay — suddenly entered the labor market. The speed and extent of the resultant hollowing out of U.S. manufacturing appears to have been too much for many workers, who tended to get stuck in lower-paying jobs or on the welfare rolls.

Economists thus realized that there was a big problem with free trade that the classical theory hadn’t prepared them for: the difficulty of adjusting to huge and sudden changes in the trading system. This should make them consider other ways that the simple Econ 101 theory might not be the whole story. During a recent discussion on the Andreessen Horowitz podcast, I laid out another reason free trade could go awry.

There’s a theory that cheap labor causes businesses to skimp on investment in labor-saving technology. When there are a whole lot of low-wage workers around, why invest in developing expensive automation or industrial robots, especially if your competitors are just going to copy your innovation eventually? Substituting cheap human hands for expensive research and development can boost profits in the short term, but in the long term it may lead to less innovation.

If this theory is right, then the China trade boom of the 2000s might have delayed the push for automation, and thus slowed down productivity growth. In the short term, a surge of cheap human labor looks just like a surge of cheap robot labor, but in the long term, human wages inevitably rise and a lack of innovation undermines further innovation. So some of the slow productivity growth that developed countries are now seeing might be an echo of free trade in the 2000s.

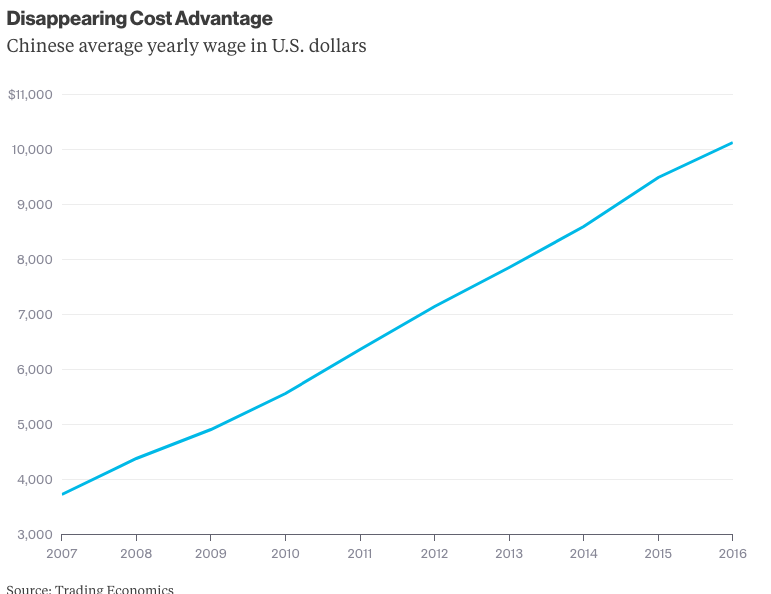

But such cases against free trade are limited in two important ways. First of all, they ignore the enormous good that free trade did for the previously impoverished people of China. Second, both cases are fundamentally about the past. Thanks to rising wages, the China shock is now over:

And there’s little chance that India or Africa, the only comparably populous areas that still have super-low wages, will step in to take China’s place anytime soon.

So is there still any case to be made against pure unilateral free trade? Perhaps. There’s also the possibility that exports raise productivity, and should be encouraged.

Economists have long known that exporters tend to be more productive than companies that focus purely on the domestic market. This could be just because high-productivity companies are more likely to compete internationally in the first place. But there is also some evidence that once a company enters world markets, its productivity actually goes up. For example, economists Sourafel Girma, David Greenaway and Richard Kneller found this sort of positive effect for British manufacturing companies. Slovenia and some other developing countries have yielded similar results. Harvard economist Dani Rodrik has argued that exporting helps companies discover what they’re good at.

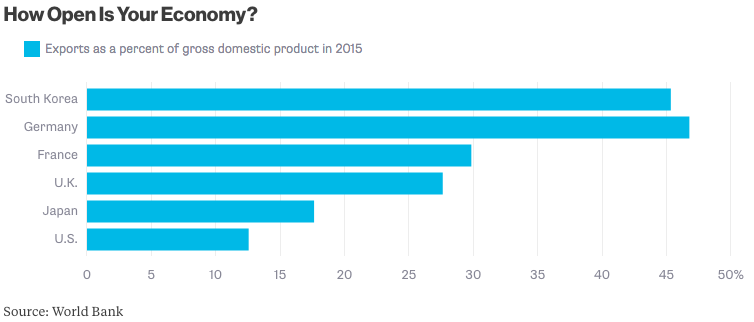

If nudging companies to export can raise productivity, the U.S. has work to do. The country’s domestic market is so big that lots of companies don’t bother to compete globally:

So exporting more might help even a high-productivity country such as the U.S. The same goes for Japan, which despite its legendary export prowess is actually a fairly closed economy.

The U.S. currently does some export promotion, via the Export-Import Bank. But this tends to focus on large companies that are already competitive in world markets. A better approach would be to provide assistance for companies to start exporting, by providing them with targeted loans, information about foreign markets and assistance developing overseas sales operations.

Also, the U.S. should consider being less tolerant of countries that intervene in markets to keep their currencies cheap versus the dollar — as China did back in the 2000s. This acts as a subsidy for those countries’ exporters, but it’s also effectively a tax on imports from the U.S. Getting tougher on currency manipulation could help U.S. companies start selling overseas.

So although the China shock is over, there are still some ways in which pure unilateral free trade might not be quite the best policy. Economists, as well as U.S. policy makers, should think more about export promotion.

Courtesy Bloomberg