Crude oil prices moved lower on Thursday, despite upbeat U.S. inventories data released in the previous session, as the minutes of the Federal Reserve’s latest policy meeting sent the U.S. dollar broadly higher.

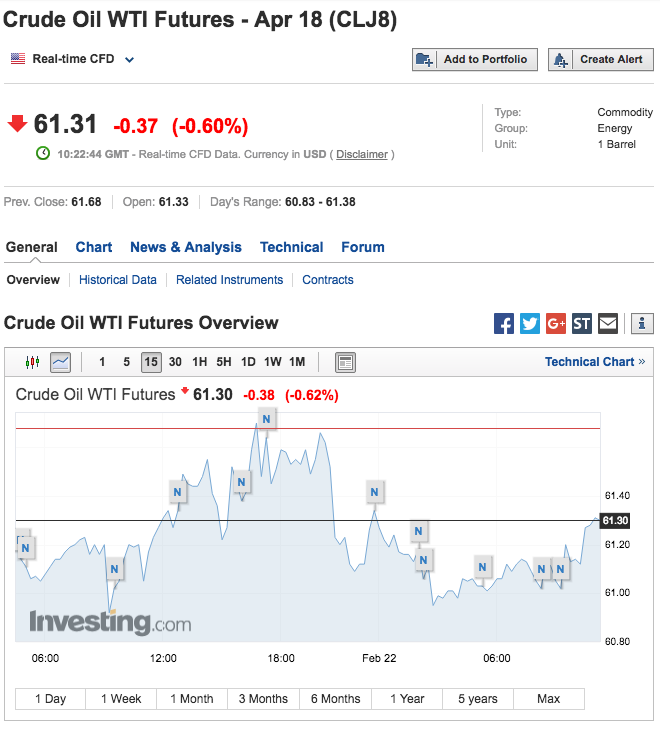

The U.S. West Texas Intermediate crude April contract was down 63 cents or about 1.02 percent at $61.31 a barrel by 10:22 a.m. GMT, the lowest since February 15.

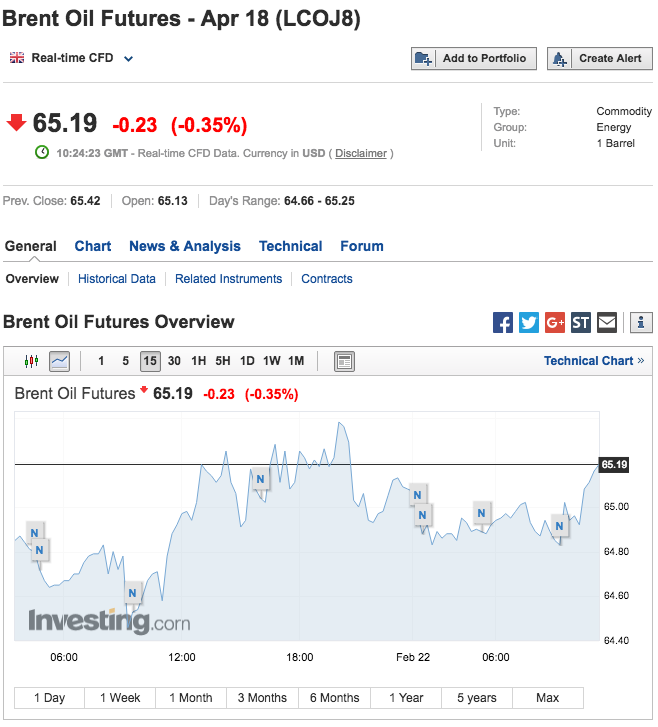

Brent oil for April delivery on the ICE Futures Exchange in London declined 55 cents or about 0.8 percent to $65.19 a barrel.

The minutes of the Fed’s January policy meeting released on Wednesday showed that central bank officials see increased economic growth and rising inflation as justification to continue to raise interest rates gradually.

The news lent broad support to the greenback despite sustained worries over the U.S. deficit, which is projected to climb near $1 trillion in 2019 following the recent announcement of infrastructure spending and large corporate tax cuts.

Venezuela’s oil-backed cryptocurrency raised $735m in one day, president claims

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was little changed at a one-and-a-half week high of 90.09.

A stronger greenback often weighs on prices for dollar-denominated commodities.

Oil traders seemed to shrug off data by the American Petroleum Institute on Wednesday showing that U.S. crude inventories fell by 907,000 barrels in the week ending February 16, compared to expectations for a 1.3 million increase.

Market participants were looking ahead to official data by the U.S. Energy Information Administration, due later Thursday.

Both reports come out one day later than usual this week due to Monday’s President’s Day holiday.

Fears that rising U.S. output could dampen global efforts to rid the market of excess supplies have systematically limited oil prices’ gains recently.

The Organization of the Petroleum Exporting Countries (OPEC), along with some non-OPEC members led by Russia, agreed in December to extend oil output cuts until the end of 2018.

The deal to cut oil output by 1.8 million barrels a day (bpd) was adopted last winter by OPEC, Russia and nine other global producers. The agreement was due to end in March 2018, having already been extended once.

Elsewhere, according to investing.com, gasoline futures slid 0.31% to $1.746 a gallon, while natural gas futures fell 0.26% to $2.652 per million British thermal units.