Investors devoted to the idea that inflation will stay subdued should be worried as worldwide data have recently made clear that producer-price increases have picked up steam. That’s led bond buyers to begin wagering that consumer inflation could be soon to follow, with U.S. breakeven rates above 2 percent in many tenors for the first time since March.

The shift represents a sea change for investors who have grown complacent about the threat of rising prices over the past few years when inflation was subdued by modest economic growth rates, suppressed wages and shifts in technology and demographics. While few are betting on runaway increases anytime soon, even a modest uptick in prices could have an outsize impact on sentiment and change the prevailing narrative.

“There is this idea that inflation is dead,” said Peter Boockvar, the chief financial officer at Fairfield, New Jersey-based Bleakley Financial Group. “But what we are beginning to see — such as in the purchasing managers’ index surveys — is a lot of talk about inflation pressures. For the markets, inflation is an underappreciated risk in 2018.’

The latest sign of prices pressures came Wednesday. U.S. manufacturing expanded in December at the fastest pace in three months, as gains in orders and production capped the strongest year for factories since 2004, the Institute for Supply Management said. The index of prices paid rose to 69 from 65.5 the month before.

Factories across the globe have warned they are finding it increasingly hard to keep up with demand, potentially forcing them to raise prices as the world economy looks set to enjoy its strongest year since 2011. Purchasing Managers Indexes published Tuesday from countries including China, Germany, France, Canada and the U.K. all pointed to deeper supply constraints.

Treasury bill supply slowdown may hurt Nigerian bank profits- Fitch

Another threat to consumer inflation comes in the form of jumps in prices for raw materials from copper to cotton in recent months, which has sent the real price of commodities from a U.S. perspective back above its long-term average. The Bloomberg Commodity Index increased 0.1 percent Thursday, its 15th straight advance, as oil climbed from the highest close in three years.

There are some nascent signs of faster consumer inflation already. German consumer-price inflation last week came in above forecast at 1.7 percent. And about two-thirds of countries in the Organisation for Economic Co-operation and Development are seeing higher core prices year on year, according to Leuthold Group LLC, citing six-month moving average data.

Policy makers have taken note, with the U.S. Federal Reserve paring back stimulus as forecasters expect it to lift interest rates three times this year. And Benoit Coeure, a member of the European Central Bank’s Executive Board, said in December that the latest extension of its quantitative easing program may be the last.

“It’s going to be a bit more difficult environment, particularly in the second half of this year, for the bond market,” said Robert Sinche, a global strategist at Amherst Pierpont Securities, who predicts four rate increases by the Fed this year and other central banks to reduce accommodation. “Markets aren’t priced for that yet.”

To Dennis Debusschere, the head of portfolio strategy at Evercore ISI, low — and stable — inflation has been a key driver behind the global market rally of the past few years.

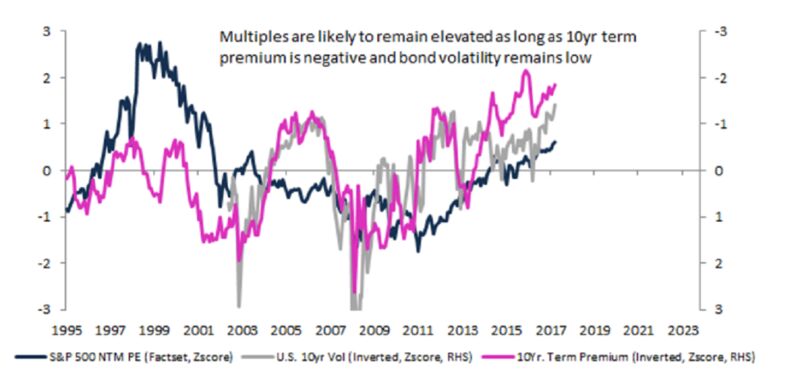

Should investors grow more concerned about inflation, spurring a material rise in the term premium — the compensation demanded for holding longer-term Treasury obligations over shorter-time notes — the equity rally could be upended, according to Debusschere.

Evercore research shows price-to-earnings multiples have tended to increase in tandem with a low term premium, as low bond yields boost the relative appeal of stocks. Previous research by Deutsche Bank AG, meanwhile, show a 1 standard deviation jump in the term premium would be associated with a 2.5 percent retreat in the S&P 500 Index.

“The fact that wages are now growing at the same time as commodity prices are rallying and capex intentions are accelerating should mean that investors face an inflation backdrop in 2018,” Jefferies Group LLC equity strategists led by Sean Darby wrote in a report Tuesday.

Report courtesy Bloomberg