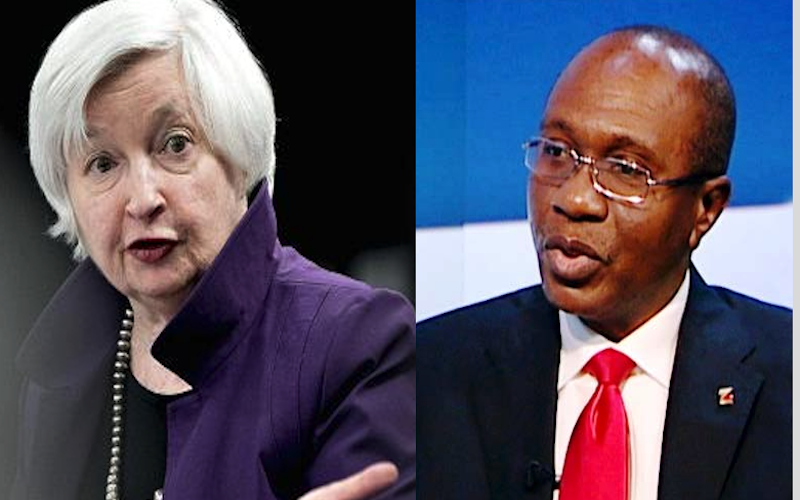

The U.S. Federal Reserves decision to hike rates from 1.0 percent to 1.25 percent as announced by its chair, Janet Yellen, on Wednesday could put emerging economies, including Nigeria, under pressure, as the decision would redirect investment flows to the U.S. at their expense.

The Fed’s rates hike is expected to redirect investments to the U.S, which has kept rates low as it tries to reflate its economy.

Yellen justified the hike by highlighting the resilience of the U.S. economy, which has been buoyed by a robust labour market. While also indicated that a third rate hike is not unlikely in 2017. An eventual increase to the 2.0 percent target could occur in the medium term, analysts predict.

She had told the U.S. Congress on 14, February 2017 that waiting too long to raise interest rates would be “unwise” as economic growth continues and inflation rises.

Already, global stock markets responded negatively to the decision as capital markets in Asia, Africa and Europe responded in unison as they opened Thursday in the red.

While Tokyo’s Topix slipped 0.2 per cent, Hong Kong’s Hang Seng index was down across the board in the early hours of trading on June 15. Though the Nigerian Capital market managed to sustain its comeback, the Johannesburg All Share Index dropped 1.15 percent as at local 12.33pm local time.

“Many African countries including Nigeria failed to take full advantage of the low rates in the U.S. while it persisted. They could have done better by investing more in infrastructure and reducing the level of macroeconomic risk so as to take full advantage of the decline in lending rates in the U.S.,” Bongo Adi, a don at the Pan Atlantic University told Businessamlive in a telephone conversation.

“With the US economy post better growth indicators and considering that it is lower on risks, which are common in emerging nation, it will take the shine off most emerging nations bonds.”

For Nigeria, this comes at a time when rating agency Fitch assigned a ‘B+(EXP) rating to its upcoming U.S. dollar denominated senior unsecured Diaspora Bonds. The rating agency put into consideration Nigeria’s Long-Term Foreign-Currency Issuer Default Rating (IDR) of ‘B+’, which has a negative outlook, in arriving at the rating for the bonds.

“One of the implications of the rates spikes in the U.S. is that the cost of borrowing at the international debt market could increase dramatically as the U.S. continues to increase its base-lending rate,” Adi said.

“To meet our borrowing targets going forward, we need to be ready to pay more.”

Furthermore, rate spikes in the U.S. could also put pressure on the sovereign rating of developing countries, many of which took advantage of low U.S. interest rates to borrow in U.S. dollars.

When the Fed last hiked rates at its December 2016 meeting, Federal Open Market Committee members indicated three more increases were likely in 2017, though many market watchers realistically now expect just two moves.

In the wake of the 2008 global financial crisis emerging markets have seen significant foreign direct investment with bonds in the U.S. and European recording lower yields, investors flocked into higher yielding emerging market stocks and bonds to bolster their portfolios yields.

“If the dollar rises in value, as is the case when there are hikes, commodity prices and emerging nation currencies could come under further downward pressure. Which is bad news because most commodities are sold in U.S. dollars, which means that they will generate less revenue in real terms,” says Adi.

With commodity prices under pressure already, emerging markets that rely on commodities may have a heavier debt burden than previously anticipated.