By Lukman Otunuga

- Nigeria inflation report under the spotlight

- Dollar supported by lingering risk-off mood

- Gold extends rebound on weak China data

Rising inflationary pressures are certainly weakening the case for the Central Bank of Nigeria to cut interest rates from 13.5% anytime soon.

Investor expectations over a November rate cut have deteriorated after consumer pricesedged up to 11.24% in September 2019, its highest in three months. Should inflation accelerate more than expected in October, the CBN islikely to leave interest rates unchanged throughout the first quarter of 2020. Although the CBN governor has stated that inflation must slow to 9% or less before examining a rate cut, signs of economic weakness due to low oil prices and external risks could force the central bank to take action. While inflationary pressuresremain a sore spot, a rate cut has the potential to boost the economy by stimulating consumption which accounts for roughly 80% of GDP.

Dollar buoyed as Fed weighs rate pause

Rising speculation over the Federal Reserve taking a pause from cutting interest for the rest of 2019 could push the Dollar higher. Given how Fed Chair Powell reiterated that is he content with the communication of a pause in interest rates cuts, the Dollar Index has the potential to break above 98.50. A combination of trade uncertainty and global growth concerns have the potential to accelerate the flight to safety, consequently boosting appetite for safe-haven assets like the Dollar. While Powell’s testimony on the economy before the House Budget Committee is significant, all eyes will be on the US retail sales report scheduled for release on Friday. Should US retail sales fail to meet market expectations, this may end up strengthening the case for further rate cuts in 2020.

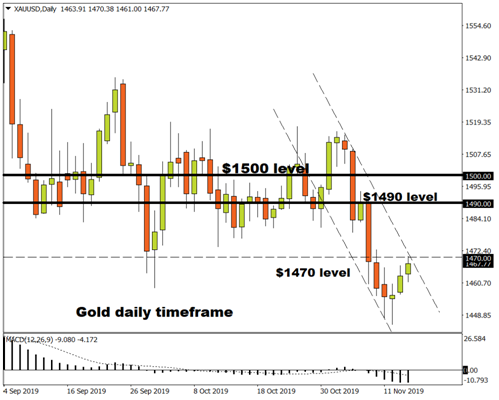

Commodity spotlight – Gold

Gold has appreciated almost 1% against the Dollar since the start of the week thanks to market caution and general risk aversion.

Tensions in Hong Kong, fading optimism over a US-China trade deal and disappointing economic data from the second-largest economy in the world have dampened the market mood. With risk appetite set to diminish further on the growing uncertainty, Gold bulls are in the position to make a return.

In regards to the technical picture, an intraday breakout above $1470 should open the doors towards $1474 and $1490, respectively.

_________________________________________________________________

Analyst Insight Lukman Otunuga