By Tara Lachapelle

By Tara Lachapelle

Could it be? Finally some enticing takeover speculation to get us through this end-of-summer M&A lull.

Estee Lauder Cos., the $39 billion New York cosmetics giant, is the latest to enter the rumor mill — and the chatter makes a whole lot of sense. Some may think of bygone department stores and shoulder pads when they hear the name Estee Lauder, but in fact the company owns hot brands such as M.A.C., Smashbox, Becca and Bobbi Brown, among others. It’s been riding a wave of sizzling growth in the prestige beauty business that’s buoyed several retailers and brands.

And this week, shares of the 71-year-old company traded at a record high:

A deal for Estee Lauder may be just what European consumer conglomerate Unilever needs to skirt future courtship by the folks at Kraft Heinz Co. It was just six months ago that Unilever spurned a $143 billion bid from Kraft Heinz and its shrewd sponsors — 3G Capital and Warren Buffett’s Berkshire Hathaway Inc. — after the negotiations leaked out and made things awkward. Since then Unilever CEO Paul Polman has been trying to pull every lever he can to primp up the company and put its stock out of Kraft Heinz’s reach. But Gadfly’s Andrea Felsted noted this week that Unilever’s sales growth remains a weak spot, which means it’s still vulnerable to overtures.

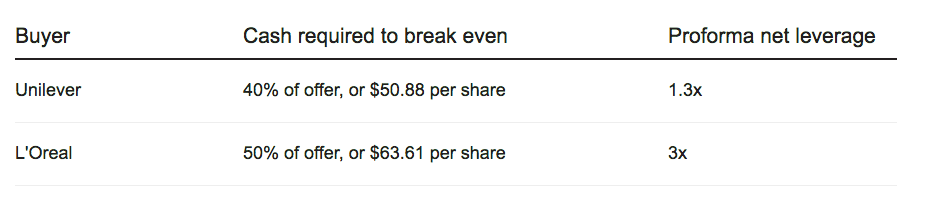

Estee Lauder could serve as a poison pill of sorts for Unilever, making it worth the high price. A quick run of the numbers shows that even before synergies, a transaction between Unilever and Estee Lauder would be accretive to earnings, so long as Unilever can put up a minimum of 40 percent of the purchase price in cash. That shouldn’t be too difficult given that Unilever doesn’t have very high leverage now and is also raising money from selling off certain food businesses.

If Estee Lauder is in play, though, things could get competitive and drive up the price. Paris-based L’Oreal SA is another obvious suitor for Estee Lauder and it could make the math work. Others have noted 3G Capital and Berkshire Hathaway could also emerge for Estee Lauder given their need to find another large acquisition, though we’re less convinced this is the target they’re after.

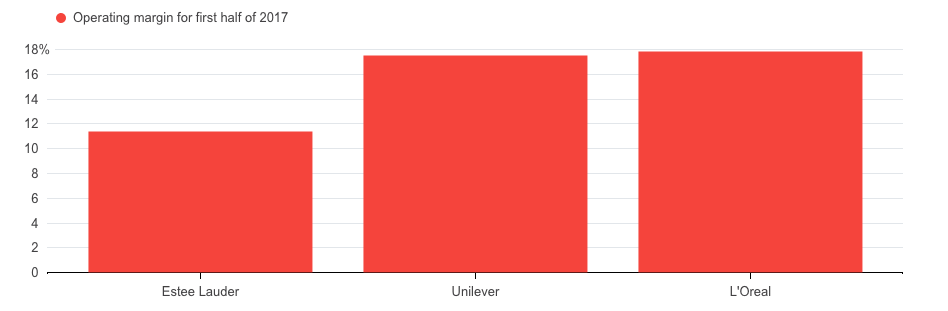

Estee Lauder’s margins are also lower than that of Unilever and L’Oreal, meaning that there may be fat to cut so that either suitor could wring out a decent amount of synergies.

Estee Lauder is appealing because it’s made astute moves to adapt to a volatile retailing environment and its e-commerce growth has been strong. As foot traffic to department stores dries up, it’s increased penetration in specialty retailers by 40 percent in the last fiscal year, muscling lines such as Jo Malone into Sephora and getting its eponymous brand stocked at some Ulta Beauty Inc. locations. Acquisitions of boutique-y lines such as Too Faced and Becca are helping it cater to the legions of shoppers that are seeking out niche brands.

Estee Lauder is pretty well-diversified across the beauty business. According to Bloomberg Intelligence, makeup comprises 45 percent of sales, skin care accounts for 37 percent and fragrances 13 percent. That’s helpful at a moment when trends are popping and dropping faster than ever. Whether a makeup fad like strobing or a skin-care craze such as micellar water gets traction, Estee Lauder is ready to cash in.

Will it cash in on a deal next? It’d be a good look for Unilever.

Tara Lachapelle is a Bloomberg Gadfly columnist covering deals.

Article courtesy Bloomberg