The Bank of Industry (BoI) and Ebonyi State government have signed a Memorandum of Understanding (MoU) on another N4 billion matching funds to improve agricultural activities embarked upon by workers in the Nigeria’s state.

This is riding by the side of the Anchor Borrowers Scheme initiated by the Central Bank of Nigeria, which the state has used to upscale its agricultural activities, especially in rice cultivation.

The N4 billion EBSG-BoI Agro-based Fund for civil servants, is coming on the heels of the N4 billion MSME Matching Fund that was activated in July 2017.

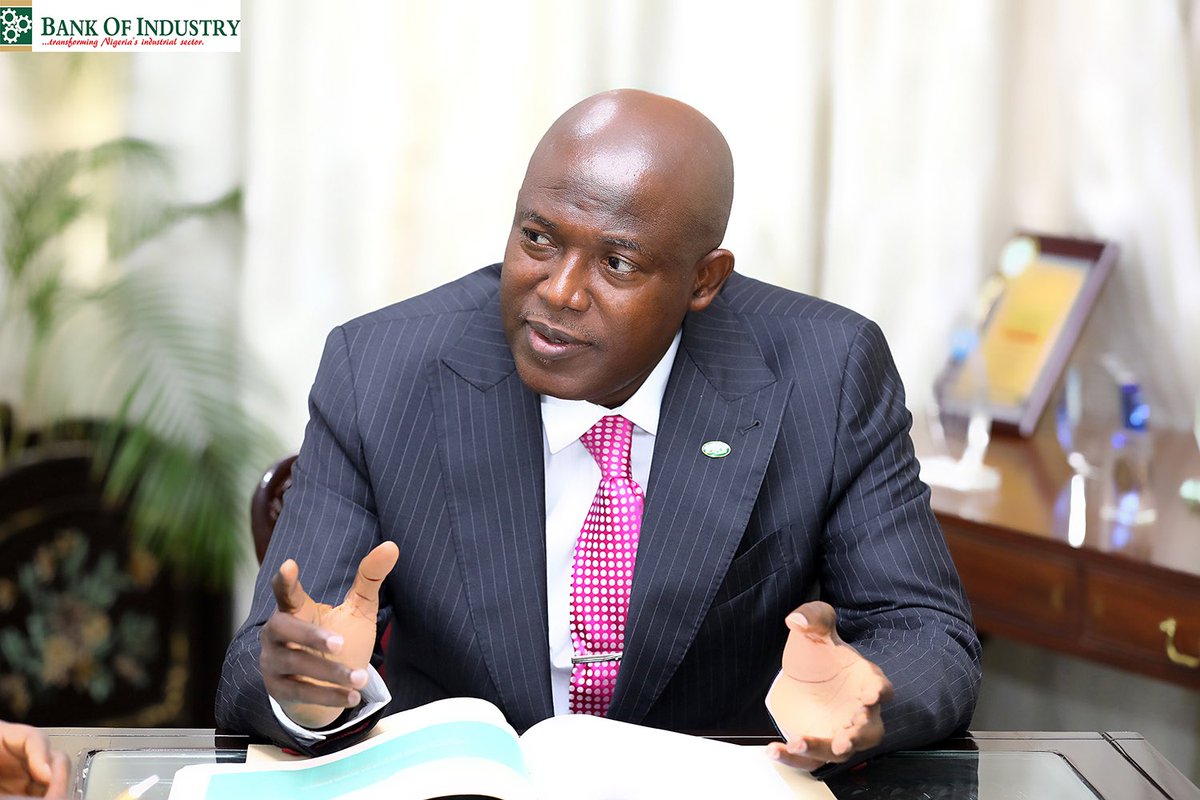

Speaking at the Ngele Oruta Township Stadium, Abakiliki, during the MoU signing ceremony and presentation of cheques to qualified applicants under the MSME scheme, Olukayode Pitan, the Managing Director of BoI, noted that the event was a consolidation of a thriving partnership between the state and the development bank.

“Today’s dual event represents an important milestone in the consolidation of the partnership and efforts of BoI and the Ebonyi state government to develop and promote entrepreneurship, develop and grow agriculture and its value chain businesses and the MSMEs in the state; to create a solid future for both the MSMEs and the State’s civil servants who are the engine room for the execution of state policies and programmes year on year,” he said.

Dave Umahi, the state Governor, noted that Ebonyi is the pioneer of such an initiative to improve the lots of civil servants across the country, stressing that proffering a solution to the low and erratic earnings of civil servants ought to be addressed as a national issue, because if civil servants are rich, the nation would be rich.

“I get so bothered about the issues of civil servants in the country, because their take home cannot match market forces and yet many states in our federation cannot pay this meager salary to civil servants,” he said.

He assured civil servants that the loans were ready to be assessed from this month of June, to enable them start off their ventures across the agricultural value chain, adding that the Constitution permits civil servants to engage in agricultural vocation.

But Pitan disclosed that both funding schemes were being offered at single digit interest rates – five per cent and 6.2 per cent for medium term (3 -5 years) and working capital financing respectively with moratorium periods (3 – 12 months).

Before presenting cheques to beneficiaries of the N4 billion MSME Fund, the Pitan commended the harmonious working relationship of the bank and the state, coordinated by the State Implementation Committee (SIC), in identifying viable MSMEs across the 13 local government councils of the state.

“So far, the bank has approved a total of 34 loans valued at over N206 million to MSMEs in the state under the Matching Fund. In addition, the Bank has also approved and granted loans worth over N3.17 billion (N1.81 billion disbursed) from its own direct funds to 22 other businesses in Ebonyi state,” he said.

He stated that the business sectors supported included rice milling and processing; quarry and solid minerals (lead mining); food processing; roofing sheet production; water bottling and packaging; mattresses and foam production, metal fabrication among others.

The bank also impacted the economy of the state through the Federal Government’s social security scheme – Government Enterprise and Empowerment Programme (GEEP), targeted at traders and artisans, which has supported 2,525 beneficiaries to the tune of N126.22 million, according to Pitan.