Dylan Waller, Frontier and Emerging Stock Markets Analyst

- Nigeria’s stock market is well worth monitoring now, given that Nigeria is Africa’s most populous country and also home to one of the world’s cheapest stock markets at the moment

- PWC’s The World in 2050 report notes that Vietnam and Nigeria could be the world’s fastest growing large economies through 2050, with an average grow rate of 6.8% through 2050

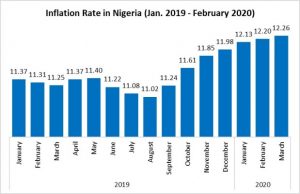

- Inflation has been a serious problem for Nigeria’s economy, as household consumption accounts for circa 80% of GDP

- The 30% YTD pullback in the ETF presents an interesting entry point for investors that are willing to hold for 5+ years.

N I G E R I A ’ S STOCK MARKET is well worth monitoring now, given that Nigeria is Africa’s most populous country and also home to one of the world’s cheapest stock markets at the moment. Nigeria’s stock market currently trades at a 50% discount to MSCI frontier markets, and it is also cheaper than every MSCI frontier market with the exception of Kazakhstan (based on MSCI constituents and not the overall market).

However, Nigeria will likely experience a setback in economic growth due to the corona-virus and plunging price of oil, and growth was only projected to be around 30-50 basis points higher than the global average before this. Nigeria’s economic growth was only projected to be around 3% during 2020 and 2021 before the corona-virus became a global pandemic, and it will likely face another recession this year or next year. However, the risk, reward potential makes a lot of sense now, and now is certainly an ideal time to begin accumulating a position in Nigeria if you are optimistic about its potential in the coming decades.

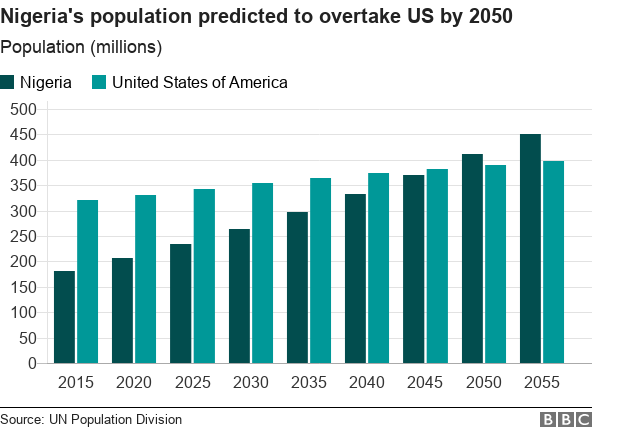

The first obvious appeal of Nigeria’s economy includes its favourable demographics, as the country has a population of over 200 million with a median age of 18. When foreign institutional investors first start looking at opportunities within frontier and emerging markets in Africa, Nigeria is the obvious first choice to examine because of its population and its economic significance in the region. Nigeria is the most populous country in Africa and it is also the 7th most populous country in the world. PWC’s The World in 2050 report notes that Vietnam and Nigeria could be the world’s fastest growing large economies through 2050, with an average grow rate of 6.8% through this time period.

Africa has the potential to have a stronger economy in the coming decades when the median age approaches 30, assuming that other improvements are made in areas such as politics, the reduction of corruption, increased manufacturing and an increase in agriculture exports, as many countries are still net food importers despite the abundance of agriculture in the economy. The development of manufacturing and tourism also hinges upon its ability to compete with established countries in Asia, which will be very difficult. I cover a lot of frontier and emerging markets that have been negatively impacted by the decline in oil prices, most notably Colombia and Nigeria. Colombia is the obvious safer choice, although buying Nigeria offers a stronger post-crash opportunity as the Global X MSCI Nigeria ETF (NYSEARCA:NGE) is down by nearly 75% on a 5 year basis. Nigeria also trades at an approximate 40% discount to Colombia, which is appealing, although Nigeria’s stock market will not ever likely command a premium to Colombia’s stock market.

NGE Down 75% in the Past 5 Years

Oil and gas exports currently account for around 10% of Nigeria’s GDP and nearly 90% of its total exports according to OPEC. Nigeria is therefore very vulnerable to oil price shocks, and also is poorly positioned in terms of export diversification. Inflation has been a serious problem for Nigeria’s economy, as household consumption accounts for circa 80% of GDP. Inflation was already in the double digits before the outbreak of corona-virus and these shocks pose a risk for potential food inflation, given that Nigeria is a net importer of agriculture products, even though it was able to increase its agriculture exports by nearly five-fold between 2016-2018. Nigeria needs to increase the quantity of sophistication of its agriculture exports to deliver stronger economic growth and also to ensure food safety, as the current uncertainty regarding global trade and agriculture production could trigger sharp food inflation.

Nigeria’s Rise in Inflation Prior to Covid-19

- Positive Notes

Nigeria’s economy has other stand out features including its relatively low public debt (below 30% of GDP), higher level of foreign exchange reserves (over 10 months of import cover) and the potential to develop its tourism industry by attracting domestic and foreign tourists. Nigeria does have the potential to develop its tourism industry, and its economy will not experience a shock from declined tourism arrivals as much as other countries such as Kenya, which depend more on tourism for growth. Tourism and travel currently only contribute to 5% of Nigeria’s GDP, up from 3.9% of GDP in 2010. Nigeria needs to diversify away from oil exports, and begin to grow its agriculture exports and to develop a stronger manufacturing sector.

Nigeria’s construction industry has also been delivering robust growth, and will likely be a key driver of growth in the coming decades as Nigeria’s urban population grows. Broad based economic growth is extremely necessary for Nigeria in particular, as the absence of this would result in extremely high youth unemployment in the coming decades, similar to what Egypt has experienced in the past decade.

Thoughts on the ETF

Nigeria’s stock market currently trades at around 5x PE and slightly below book value, and the stock market also has a 9% dividend yield. The Global X MSCI Nigeria ETF (NGE) invests in equities in Nigeria in the following areas:

- Financial Services (49.3%): The ETF invests the majority of its assets in banks, which is ideal given the extremely low valuation found in some banks in Nigeria. However, the country’s NPL ratio was over 10% as of the end of 2018, and will likely increase this year.

- Consumer defensive (25%): The ETF invests in some consumer names, including Nigeria Breweries, all of which will likely have favorable long term growth. However, food inflation could offset the financial growth of companies like breweries and companies like Nestle, if the price of rice and vegetables rise rapidly this year.

- Basic Materials ( 15.5%): Construction stocks are also favorable long term bets, given that Nigeria’s economic growth will exceed 6% per annum in many years during the coming decades. The circa 30% YTD decline in the ETF presents an interesting buy opportunity for investors who are bullish on Nigeria’s long term potential, and willing to hold for 5-10 years.