Charles Abuede

A weakening naira is what analysts are holding to account for a continuous rise in Nigeria’s inflation as the country’s National Bureau of Statistics (NBS) released new data Friday showing the rate has gathered speed for the 10th consecutive time to reach 12.56 per cent year-on-year.

The increase is 0.16 per cent higher than the figure of 12.40 per cent recorded in May 2020. The data also revealed that the headline index rose by 1.21 per cent in the month under review and 0.04 per cent higher than the 1.17 per cent recorded in May when compared on a month-on-month basis.

The report released by the Abuja-based statistician general office revealed that the urban inflation rate increased to 13.18 per cent year-on-year in June 2020 from 13.03 per cent recorded in May 2020, while the rural inflation rate increased to 11.99 per cent in June 2020 from 11.83 per cent in May 2020.

Meanwhile, during June, the food index, which accounts for more than half the inflation basket rose by 15.2 per cent, the most since March 2018.

In the same vein, food inflation on a year on year basis was highest in the northern states, as Sokoto (17.88%), Plateau (17.04%) and Abuja (16.82%) recorded highest figures, while Lagos recorded 13.46%, Ogun (13.18%) and Bauchi (12.86%) recorded slowest rate rise. Similarly, on a month-on-month basis, Kogi (3.07%), Benue (2.41%) and Zamfara (2.24%) recorded the highest rise, while Ondo (0.47%), Anambra (0.42%) and Lagos (0.18%) recorded the slowest rise.

“The rise in the consumer price index, (CPI) which measures inflation, however, can be attributed to the restrictions on access to foreign exchange in the market and the continued border closures could drive up prices,” an economic expert said.

Analysts, who are familiar with the matter, have highlighted major talking points on the statistic from the NBS, citing that the increase in Nigeria’s inflation might have been precipitated by:

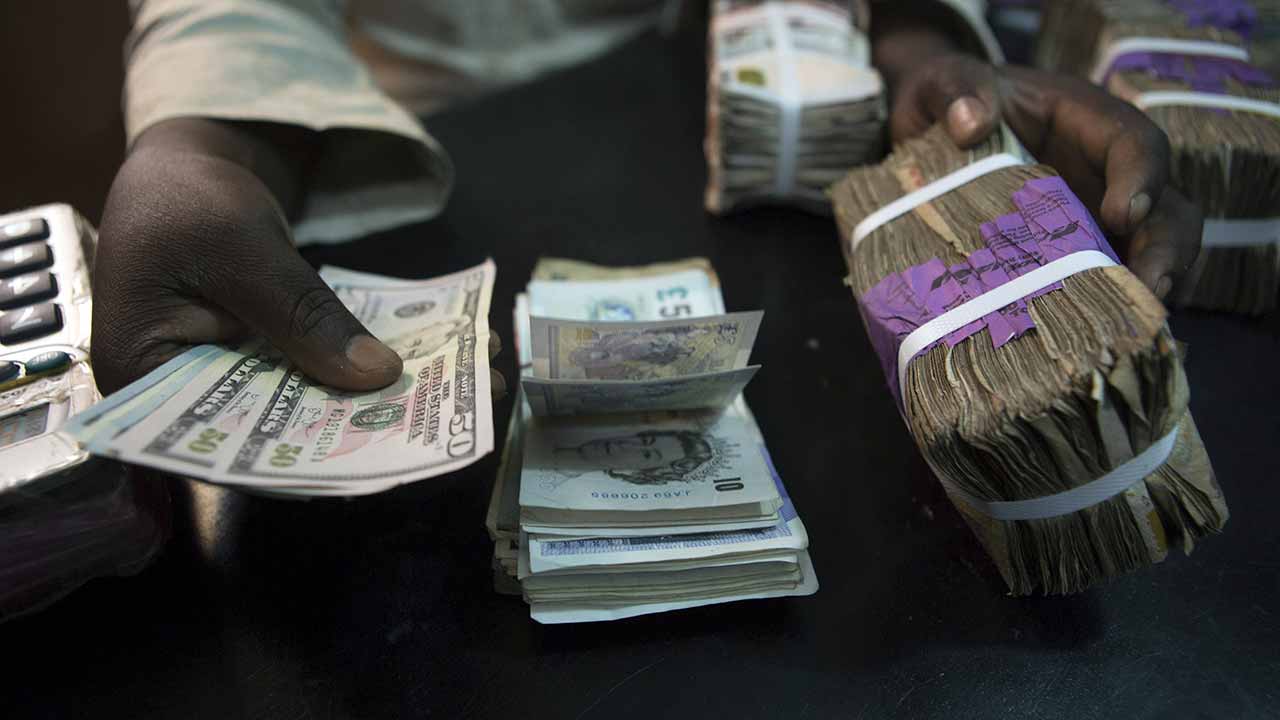

The weakening of the naira in the exchange rate market, which in one way or another had added to food inflation that has before now been pushed up by border closures, the clashes between herders and farmers, coupled with the restrictions aimed to curb the spread of the coronavirus.

Also, recent moves by the Central Bank of Nigeria (CBN) to end official forex supply for corn imports to boost local production which, circuitously, could lead to shortages and apparently drive businesses to look into the parallel market for access to foreign currency, are also being fingered to have kept inflation high.