Crude oil prices trimmed gains on Monday, following news of an increase in U.S. output although traders remained hopeful ahead of a meeting between OPEC leaders and U.S. shale producers later in the day.

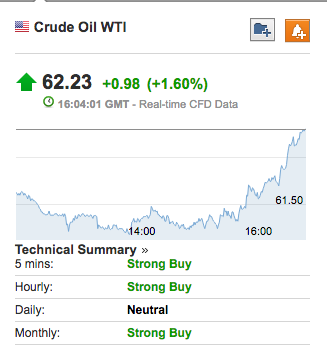

The U.S. West Texas Intermediate crude April contract was up 42 cents or about 0.69% at $61.66 a barrel by 14:20 GMT, off Friday’s two-and-a-half week lows of $60.13.

Elsewhere, Brent oil for May delivery on the ICE Futures Exchange in London rose 27 cents or about 0.42% to $64.64 a barrel, after hitting a two-week trough of $63.20 on Thursday.

Oil prices pulled back from session highs after the International Energy Agency on Monday upwardly revised U.S. oil output growth, saying the country would be producing a total of nearly 17 million barrels per day (bpd) in 2023.

U.S. crude oil production has already surpassed that of top exporter Saudi Arabia to 10.28 million bpd.

Rising U.S. output has weighed on oil prices in recent months amid fears it could dampen global efforts to rid the market of excess supplies.

The Organization of the Petroleum Exporting Countries (OPEC), along with some non-OPEC members led by Russia, agreed in December to extend oil output cuts until the end of 2018.

The deal to cut oil output by 1.8 million barrels a day (bpd) was adopted last winter by OPEC, Russia and nine other global producers. The agreement was due to end in March 2018, having already been extended once.

But prices were still supported as market participants were eyeing an upcoming meeting between OPEC oil ministers and U.S. shale firms scheduled later Monday in Houston for the largest energy industry conference, CERAWeek.

Elsewhere, gasoline futures slid 0.37% to $1.903 a gallon, while natural gas futures advanced 0.74% to $2.715 per million British thermal units.

Oil windfall expectations from the Middle East crisis